H&r block tax estimator 2020

In other words you might get different results for the 2021 tax year than you did for 2020. Enjoy paying bills and managing all of your money in one card.

Business News Today Read Latest Business News India Business News Live Share Market Economy News The Economic Times Income Tax Notice Meaning Income

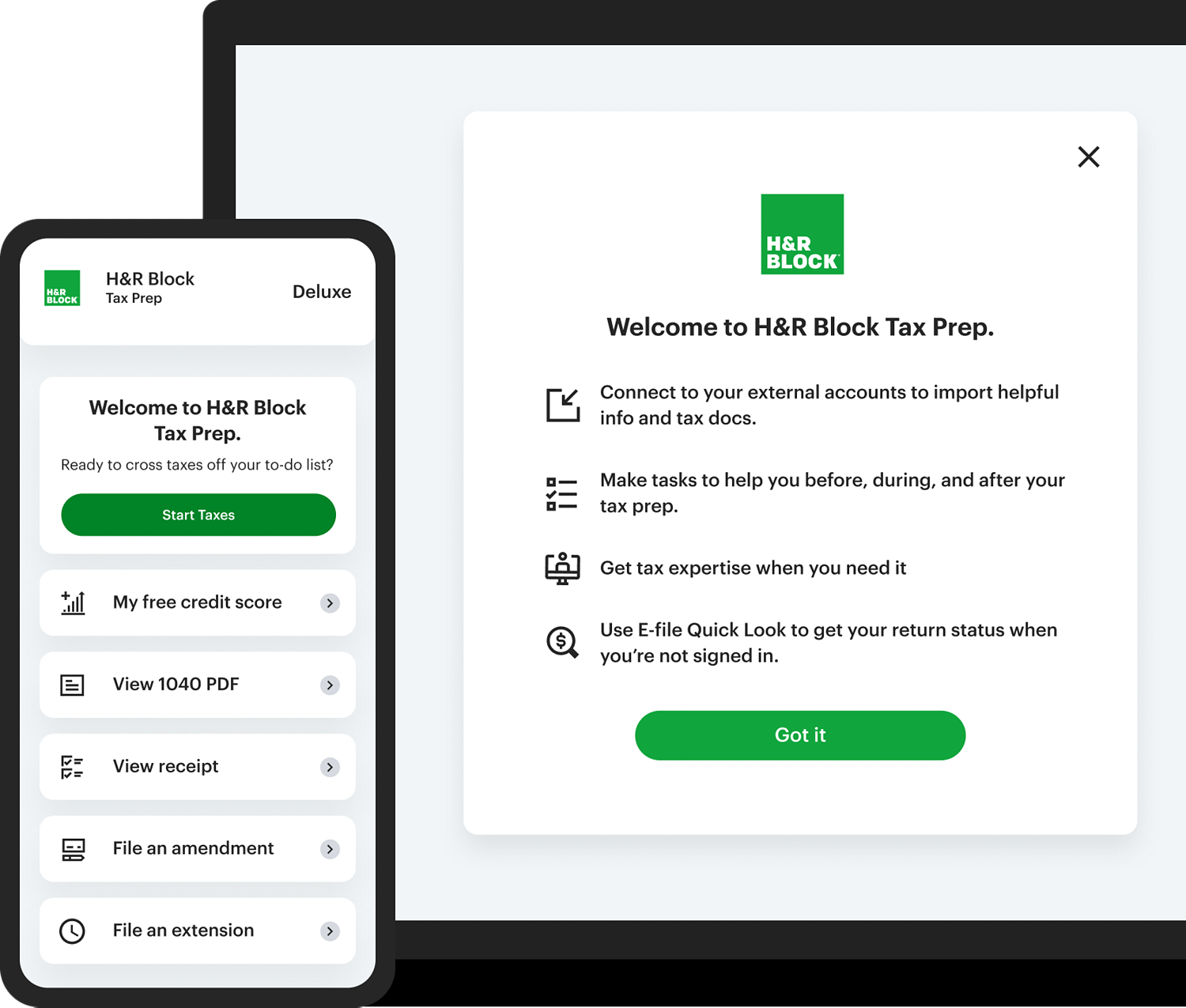

The HR Block tax calculator 2022 is available online for free to estimate your tax refund.

. TaxPlan TaxPlay TaxWin. All prices are subject to change without notice. Agency a state the District of Columbia a US.

Technically tax brackets end at 123 and there is a 1 tax on personal income over 1 million. Expires January 31 2021. Lets look at TaxCaster and see how it analyzes your income and key tax factors to.

To change your tax withholding amount. 2022 Tax Calculator Estimator - W-4-Pro. Prepare and eFile your 2020 Tax.

Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. IT is Income Taxes. No cash value and void if.

If you did not file a 2020 Return or you are affected by the IRS verification processing delays as described below enter 0 for 0 as your prior-year AGI verification. Its never been easier to calculate how much you may get back or owe with our tax estimator tool. The countys average effective property tax of 153 ranks as one of the highest rates in.

CTEC 1040-QE-2355 2020 HRB Tax Group Inc. 2022 Tax Return and Refund Estimator for 2023. Resulting in a tax due upon the filing of your 2020 return in the amount of 1520.

When to Use a Tax Liability Estimator and Check Withholding. See back tax resources to file a past due 2020 Return. Learn about the HR Block Emerald Card that makes it easy to access your tax refund and more.

Tax Year 2020 Basic CA1599 per return. All prices are subject to change without notice. Starting in January 2020 you can prepare and eFile 2019 IRS and State Tax Returns.

It is an advance payment of a tax credit you qualify for on your 2021 tax return due on Tax Day April 18 2022. HR Block tax software and online prices are ultimately determined at the time of print or e-file. The information below applies only to the first stimulus payment issued in 2020.

Property tax rates in Ohio are higher than the national average which is currently 107. If you filed a 2020 Return using the non-filers tool in 2021 for the advance Child Tax Credit or 2020 Recovery Rebate Credit enter 1 for 1 as your prior-year AGI verification. The Advance Child Tax Credit for 2021 or AdvCTC as part of the American Rescue Plan Act is a refundable tax credit.

HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040. In reality your joint tax return will show a total of 40000 in wages 20000 for each you and your spouse and after subtracting the 24800 standard deduction your taxable income will be 15200. See tax calculators and tax forms for all previous tax years or back taxes.

After You Use the Estimator. Learn more why Tax Return Results differ. Tax credits directly reduce the amount of tax you owe dollar for dollar.

Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. HR Block is a registered. Given that this tool comes in handy we wanted to break down the HR Block Tax Calculators process and provide a little education on how the HR Block Tax Calculator works.

H and R block Skip to content. Because tax rules change from year to year your tax refund might change even if your salary and deductions dont change. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

Possibly plus penalties and interest. Submit or give Form W-4 to. Quick tips for entering your 2020 AGI.

Such as TurboTax HR Block. Start Now - For Free. You are not required to file Form 1099-INT for payments made to certain payees including but not limited to a corporation a tax-exempt organization any individual retirement arrangement IRA Archer medical savings account MSA Medicare Advantage MSA health savings account HSA a US.

Not one price for each state like TurboTax or HR Block. As part of the Mental Health Services Act this tax provides funding for mental health programs in the state. The TurboTax TaxCaster is an all-in-one online tax tool that helps you work out a range of tax-related figures.

And the 2020 reappraisal began in August of this year. Claim First Stimulus in 2022. CTEC 1040-QE-2355 2020 HRB Tax Group Inc.

All prices are subject to change without notice. Offer valid for returns filed 512020 - 5312020. By clicking the Subscribe button you consent to receiving electronic messages from HR Block Canada regarding product offerings tax tips and promotional materials.

It will be updated with 2023 tax year data as soon the data is available from the IRS. It functions like a normal income tax and means that the top marginal rate in California is effectively 133. If you did not receive this payment you can claim the money via the Recovery Rebate Credit on your 2020 Tax Return which was due on October 15 2021.

However since the 2021 IRS return is due by that date all your state income. This free tax refund calculator can be accessed online and because you can use the calculator anonymously you can rest assured that your personal information is protected. 2022 Tax Calculator Estimator - W-4-Pro.

Most state income tax returns are due by April 18 2022 with a few exceptions. Estimate your tax refund with HR Blocks free income tax calculator. This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022.

DoIT Less Taxing at. Use your estimate to change your tax withholding amount on Form W-4. HR Block tax software and online prices are ultimately determined at the time of print or e-file.

Tax Year 2020 - Form 140X Tax Year 2019 - Form 140X Tax Year 2018 - Form 140X. HR Block is a registered. Both reduce your tax bill but in different ways.

HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040. Ask your employer if they use an automated system to submit Form W-4. Handles all tax scenarios and gives you the confidence to file with accuracy and security.

HR Block tax software and online prices are ultimately determined at the time of print or e-file. 2022 Tax Calculator Estimator - W-4-Pro. If the return is not complete by 531 a 99 fee.

Expires January 31 2021. Taxes Made Simple Again. To begin tax preparing start up the 2021 Tax Return Estimator to get a good idea of.

Expires January 31 2021. Tax Refund Estimator For 2021 Taxes in 2022. A tax credit valued at 1000 for instance lowers your tax bill by 1000.

Taxes File taxes online Simple steps. The tax credit amounts will increase for many qualifying taxpayers giving parents or guardians up to 3600 per child. Ready to Prepare and eFile Your 2021 Taxes.

CTEC 1040-QE-2355 2020 HRB Tax Group Inc. HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2355 which fulfills the 60-hour qualifying education requirement imposed by. Or keep the same amount.

Premium Tax Preparation Software H R Block

What To Do If You Owe The Irs Back Taxes H R Block

Premium Tax Preparation Software H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Your Tax Filing Options H R Block

H R Block Tax Import Partners H R Block

Tax Pros 3940 Broad St San Luis Obispo Ca

Premium Tax Preparation Software H R Block

Premium Tax Preparation Software H R Block

Filing Taxes With Your Last Pay Stub H R Block

Premium Tax Preparation Software H R Block

Deluxe Online Tax Filing E File Tax Prep H R Block

H R Block Tax Preparation Office 707 Boston Post Rd Old Saybrook Ct

Why I Use Freetaxusa Instead Of Turbotax Or H R Block To File Taxes Deudas Renta Ingresos Y Gastos

H R Block Tax Pro Go At Walmart H R Block Newsroom

10 Important Financial Metrics To Build Wealth Wealth Building Personal Finance Finance

H R Block Tax Preparation Office 707 Boston Post Rd Old Saybrook Ct